I will never forget the month when my daughter received her college tuition bill and I found my dad in need of a new prescription that was not fully paid by Medicare. Looking at these two envelopes, I sensed that the “sandwich” was closing in on me–the nightmarish squeeze between the demands of my children and what my aging parents needed.

You may well feel that way, as you are reading this. You’re not alone. The Sandwich Generation includes millions of Americans who are stuck in a financial and emotional tug-of-war. The pressure is there but a plan will change panic into calmness.

Problem This Guide Resolves: Financial Overwhelm and Burnout.

The following guide is aimed at responding to the key problems you may encounter:

- The “Double-Duty” Drain: The unceasing economy of two generations that is threatening your own retirement savings and causing a guilt-stress cycle.

- The “Unknown Unknowns”: The worlds of college financing and elder care without a roadmap.

- The Emotional Toll: How financial strain increases the emotional burden of caregiving that results in burnout.

At the end of this article you are going to have a very actionable step-by-step plan to get your finances straight, take care of your loved ones and, above all, your future.

The Financial Survival Plan Step by Step.

You cannot draw out what is not in the cup. The most important thing to do is to first find your own breathing apparatus. This is not personal, it is strategic. You can not help anybody when you burn out or even go bankrupt.

Step 1: Strengthen Your Own Risings.

- Audit Your Cash Flow: Over one month, trace each and every dollar that enters and leaves the company. It is impossible to control what you do not gauge. You can use a basic spreadsheet or a budgeting application to classify your expenditures.

- Get Your Budget Sharped: Prepare a new budget: the Sandwich Generation Budget that includes three new categories:

- Child-Future Costs: (e.g., college fund, extracurriculars)

- Parent-Support Costs: (e.g., medical co-pays, home modifications)

- Your-Retirement Savings: (This cannot be negotiated)

- Stock Your Emergency Fund: You should have 6-9 months of necessities. This is your cushion against all parent health bills and other unexpected child expenses. Store in a high yield savings account.

Step 2: Have The Talk with Your Parents.

It is a hard but essential conversation. Treat it with pity and regard.

- Make it a Partnership: “I want to make sure that we can do what you want and serve you the best I can. In order to do so, I must know about your financial and health plans.

- Find the most important information: You should know:

- Where Documents are Stored: Where do their Will, Power of Attorney (POA) and Advance Healthcare Directive reside?

- Income: How do they make money (Social Security, pensions)? Are they retirement or other investments?

- Healthcare Coverage: Learn about their Medicare (Parts A and B, Part D and any Medigap policy) plans. What will they do about long-term care?

Step 3: Plan Your Children’s Future (Without Planning Your own)

Get Realistic about College: Have a real talk with your teenager about the real deal about college. Consider every possibility: community college the first two years, in-state public universities, scholarships, grants and federal student loans (which are in the name of the student).

Put Retirement over 529s: It hurts to say, but you can borrow to go to college, but you cannot borrow to retire. When cash is lean, make sure that your retirement savings are on schedule before you over-fund a 529 plan.

Step 4: Optimize Government and Community Resources.

You need not do it all yourself. Tap into available support.

For Your Parents:

Medicare Savings Programs: Assist in covering Medicare premiums and out of pocket expenses of those with limited incomes.

Local Area Agencies on Aging: Resources for in-home care, meals delivery (Meals on Wheels), and transportation.

Veterans Affairs (VA) Benefits: In case your parent is a veteran, they might be entitled to pensions or Aid and Attendants benefits.

For Your Kids:

FAFSA (Free Application for Federal Student Aid): It is required annually when attending college. You need to provide your financial details.

State and Local Scholarships: State and local scholarships are not as competitive as national ones.

Step 5: Insure and defend all with appropriate legal and insurance forms.

Important Documents to be Had by Parents: They should have a current Will, Durable Power of Attorney (financial matters), and an Advance health Care Directive (Living Will). This enables you to make their decisions in case they get incapacitated.

Check Yourself: Have you adequate disability insurance? When your income is gone so is your whole support system. Also you may want to think about term life insurance to insure your family in case something should happen to you.

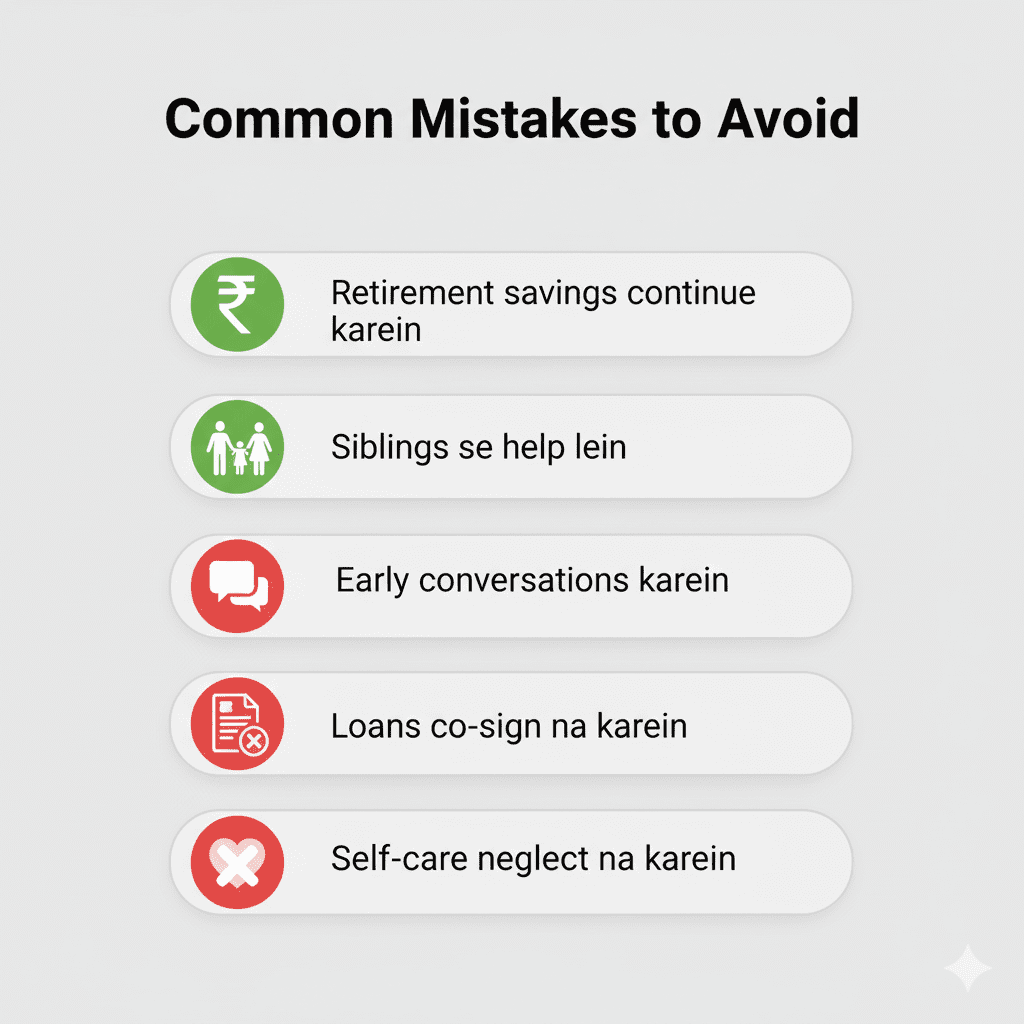

Common Mistakes to Avoid

- Delaying Your Retirement: This is the biggest error. Retirement Compounding Time is the most valuable. Cessation of contribution, even a few years, has a huge long-term effect.

- It is Not You versus the World: You are not the coordinator and the only funder or parent. Recruit family members and siblings, and community resources to distribute the burden.

- Failing to Have the Talk Before the Crisis Strikes: It is a thousand times more difficult to think rationally about financial and medical choices in an emergency. Now, when they are all calm, have the conversation.

- Signing Loans blindly: Co-signing a personal loan to send your child to college or a loan to a parent under the assumption they can never make their payments puts you 100 percent in the hole. This will ruin your credit and your finances.

- Too Busy To Take Care of Yourself and Your Marriage: The everyday worry may wear you down. Block off self-care time, date night, and therapy (where appropriate). Your family is best off with a healthy you.

My own suggestion: The Family Financial Summit.

I scheduled a yearly “Family Financial Summit,” and that is what worked for me, and what I now recommend to all of my friends in this situation.

Pick a quiet weekend. Sit down with your partner (and separately, with your parents if suitable) and have a look at:

- Last Year: What were some of the unforeseen expenses? What worked well?

- The Future: What will you be spending in the upcoming year (e.g., senior year of high school, a surgery you are scheduled to get)?

- The Documents: See that all are acquainted with the location of valuable documents.

- The Budget: Revise your family budget.

It formalizes the process, cuts down on anxiety, and, in so doing, turns financial planning into a group activity rather than a covert liability. It changed my sense of squeeze to one of being strategic and in control.

Question

Q:I feel like a bad person saving to retire when my parents are in need now. What should I do?

This is a very common feeling. Keep in mind: you are protecting your future, and will not become the financial burden to your own children further on in life. Your retirement savings should be the last link in a chain of generations of financial stability. It is not cynical; it is conscientious. Assist your parents but that should not come at the cost of your future basic needs.

Q:Am I under a legal obligation to pay my parents their debts?

You have no legal obligation to your parents, in the United States, to repay their debt unless you signed a loan or credit agreement to do so. You may be contacted by debt collectors, but your duty is usually moral rather than legal. But in the event that a parent dies, they will use their assets (estate) to settle their debts before any inheritance is given.

Q:What can I do to get my siblings to contribute more, financially and care giving?

Start a non-accusatory discussion. Put it like this, “We are all in it and I am asking you to help me take care of Mom and dad the best way. Be specific in your tasks. One of the siblings could bring in some money and the other sibling who is closer can take the doctor appointments. The third one might take care of the bills over the internet. Assign tasks and ensure everyone is updated by using tools such as shared calendars and family group chats.

Q:So when should a parent be thought of as being assisted living or going to a nursing home?

This is a hard choice with regard to safety and care requirements, not only in the money. The main red flags can be viewed as: falls, not taking medication on time, poor hygiene, deteriorating mobility, and other indicators of dementia such as leaving the stove on or becoming lost. You should seek the opinion of their doctor. This is aimed at making them safe and quality in life, even when making a difficult transition.

Q:Should I withdraw money out of the equity in my home (a HELOC) to fund my child to college?

This is widely thought of as being a high risk strategy and not all people should do it. You are turning a non-secured cost (education) into a secured debt, secured by your house. Unless you are able to re-pay the HELOC, you will be exposed to foreclosure and loss of your home. Scholarships, grants, federal student loans, and cheaper schools should be exhausted before even this option is considered.

Q:What is Long-Term Care Insurance, do my parents or I have one?

- Long-Term Care (LTC) Insurance is intended to pay out of the other expenses not paid out by traditional health insurance or Medicare (help with dressing, bathing, playing cards in a nursing home, assisted living facility or at home). It can be a saving grace.

- To Your Parents: The youngest age at which to purchase LTC insurance is during the late 50s through mid-60s when premiums are cheaper and they more likely will qualify. When they are already in ill health or are older, it can be prohibitively costly or unavailable. Read their policies to be aware of the coverage.

- To You: If your family has a history of chronic illness, buying yourself a policy in your 50s is a smart decision to avoid having your children deal with the same financial strain you are currently dealing with. It is an important component of securing your own retirement funds.

Q:What will be the impact on my taxes in supporting my parents?

There are certain tax benefits which you might be qualified to benefit.

- Treating Your Parent as a Dependent: You may treat your parent as a dependent with more than one-half of his or her financial support during the year, gross income less than a specified amount (usually the amount of the standard deduction), and other IRS tests. This will be eligible to earn you a tax credit.

- Medical Expenses: You can include the medical expenses that you paid on behalf of your parents as part of your own medical expense deduction calculation (assuming you itemize deductions, and your total medical expenses are over 7.5 percent of your Adjusted Gross Income).

It is important to enlist the help of a tax expert to make the right cuts through these regulations and make sure you are claiming all the deductions you are entitled to.

Q:My parents are moving in with me. Which financial issues are we supposed to talk about first?

This setup may be awesome but there must be financial boundaries lest the arrangement breeds resentment.

- Formalize a Contribution: Is he going to contribute to the mortgage/rent, utilities or grocery? A tiny sum of money can be of use. Write a mere contract.

- Household Changes: Discuss who is going to finance any safety changes needed (e.g., grab bars, a ramp, a bedroom on the first floor). This may be a huge initial expense.

- Revise the Budget: Include the higher price of utilities, food and household supplies in your new Sandwich Generation Budget.

Q:I’m an only child. What should I do to cope with the pressure when I have no other siblings to help them out?

This can be too much weight and a support system is even more essential.

- Build Your “Chosen Family: Be active in creating a network. This also involves friends, neighbors, and parents of friends of your children who may also be in the same situation, to offer emotional support.

- Delegate and Hire Out: You are not good at everything. House-help on specific chores such as lawn care, house cleaning, or a home health aide a few hours a week should be hired, if financially viable, to allow yourself a break. It is a necessary and well warranted cost.

- Identify a Support Group: Try to identify online or local in-person support groups of the Sandwich Generation or caregivers. A conversation with individuals that can appreciate your special struggles is extremely affirming and provides tips to use.