Introduction & Personal Story

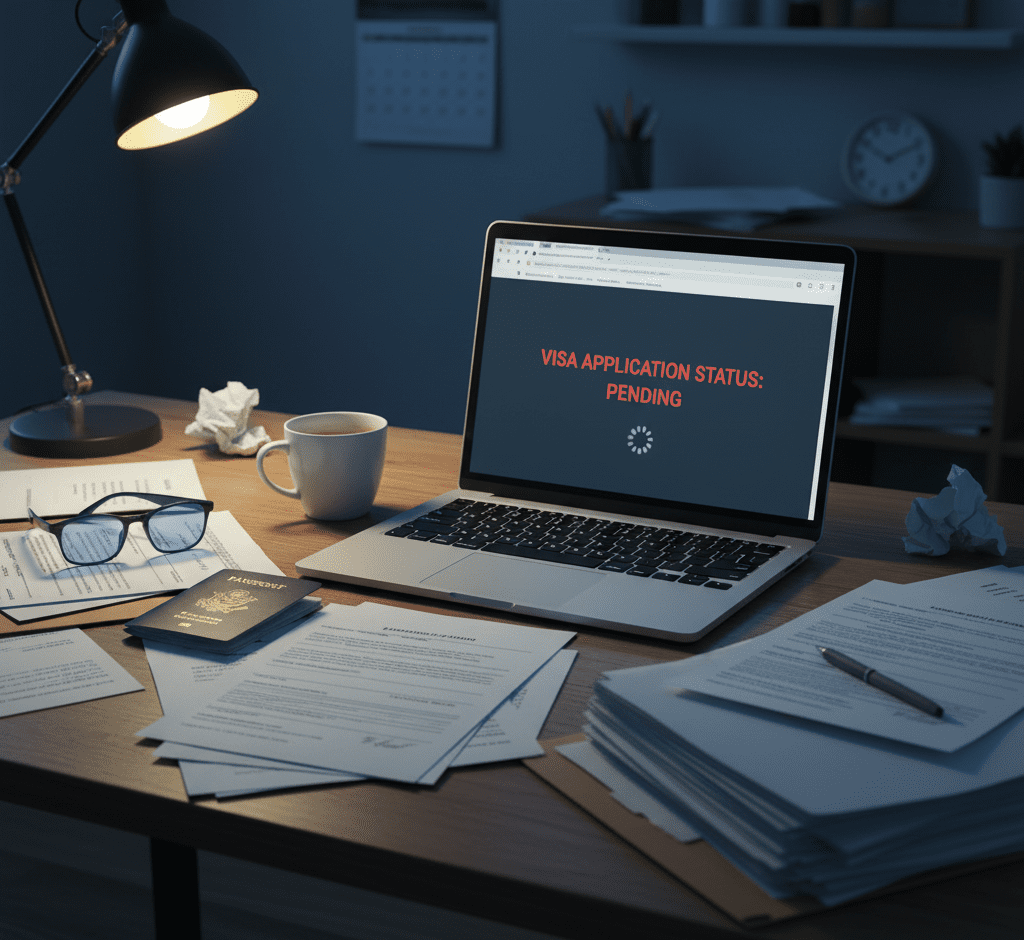

The message left in the voicemail was short and shivers ran down my spine. Your H1B has been chosen to undergo further examination. We will update you in 60-90 days.” I was in a middle ground–not working, rent to be paid in two weeks and no hope of what would happen to me. At this point of pure panic, my emergency fund was not merely a budget category to me, but a lifeboat. It was a difference between stuffing my bags in a defeatist manner and having a breathing room to hire an immigration lawyer and go through the stressful experience. It made me understand that not every single finance book can teach me something: as a foreigner in America, you need an emergency fund not as your goal of saving but as your weapon of the first line.

What is an Emergency Fund?

An emergency fund is a special fund of readily available cash that is stored up to meet such sudden and urgent financial shocks. Consider it an individual financial airbag–you don’t want to visit it, but it is absolutely essential to your security in the event of a crisis.

The important word here is the emergency. This is not a money fund that is intended to be spent on things such as vacation, marriage present to a relative in India, or diwali sale. Strictly speaking, unknown accidents. These crises may seem quite particular to Indian immigrants and students in the USA:

- An accidental medical-copay or deductible.

- Emergency, last minute airline tickets to India on account of a family emergency.

- Large scale automotive maintenance (a necessity in most US cities).

- Loss of job or unemployment due to visa processing delays (such as H1B, extension of allotment of temporary housing).

- A large, unexpected tax bill.

The fund must be in a safe, liquid account such as a high-yield savings account where the money can be accessed promptly without any penalty or any risk associated with the market.

The Case of an Emergency Fund that Indians in the USA must have, no one can afford to compromise.

In the case of us, who have relocated to the USA, finances are different, the stakes are usually higher. Everyone should have an emergency fund, but in this case, it is especially essential because of the following reasons:

The Visa Uncertainty: We have the visa in our lives in the U.S. With a denial of an H1B, or an RFE (Request for Evidence), or an OPT gap, it may cause an immediate loss of income. This is in contrast to citizens who do not have that option of staying and finding employment. An emergency fund will purchase you the much needed time to decide what to do next, be it to apply for a new visa, see an attorney, or even to plan a transition, without the sense of urgency of the next monthly rent.

The High Cost of Cross-Border Emergencies: The emergency in your family at home needs urgent and most likely costly attention. Flights that are made at the last moment to India can be in thousands of dollars. With an emergency fund, you can go ahead and book a flight without depleting your normal savings or taking on debt and instead spend more time on what really matters, your family.

The US Healthcare System: Healthcare in America is infamously costly. With good insurance, one may be charged a huge deductible or co-pay in case of a visit to the ER. A medical problem does not develop into a tragic financial crisis due to emergency funds.

Breaking the I May Ask Family Cycle: Family is the safety net that most of us are raised on. Although that support system is valuable, making use of it during transatlantic financial crises can be a stressful experience to everyone. One of the most effective ways to become independent and become an adult is to build your own emergency fund. It makes you relaxed, and spares your family back home the worry and the money stress.

Avoiding Bad Debt: With no savings to fall back on, some unexpected cost would compel you to use high-interest credit cards or call on personal loans. Clawing oneself out of such a debt may require years and sabotage other financial aspirations such as saving a down payment or investment towards retirement.

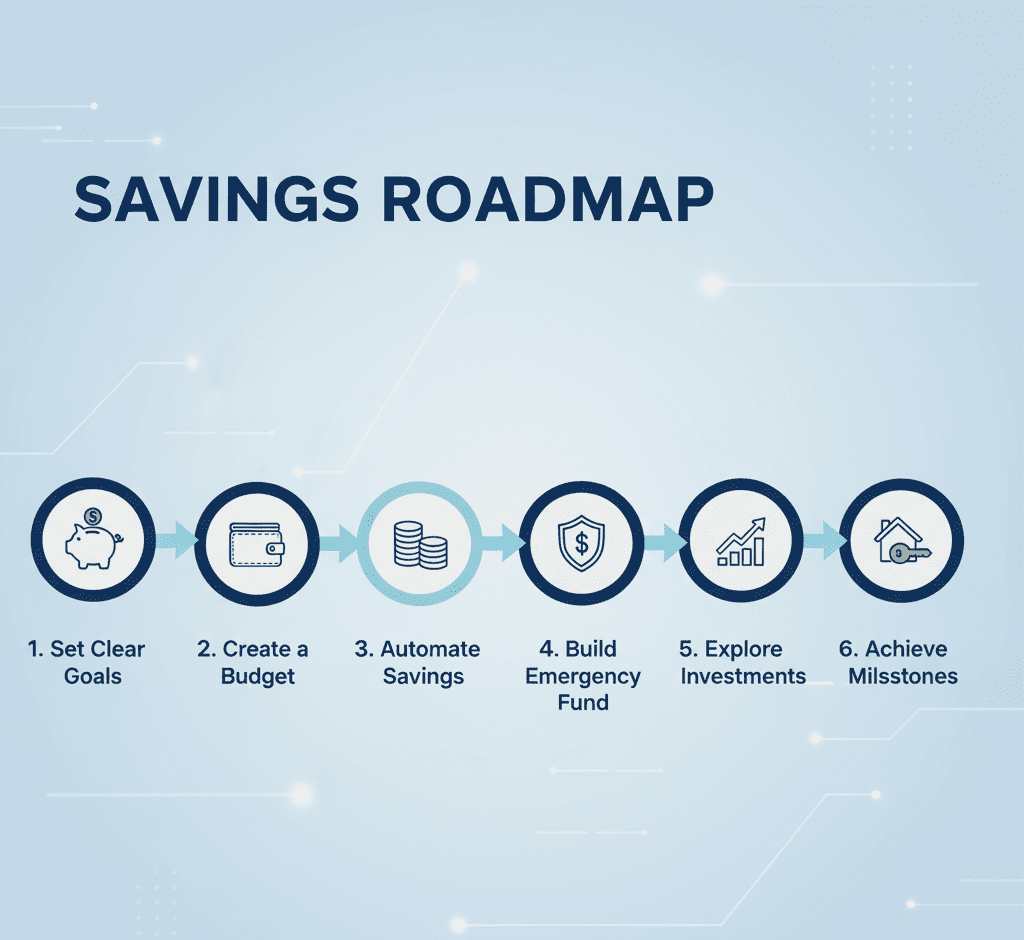

A Step-by-Step Guide on How to Build Your Emergency Fund in 2025.

It is tempting to look at the wealth of having a huge cash reserve to fill, particularly on a student budget or an entry-level salary. It is all a question of being consistent and strategic.

Step 1: Set Your Target Number

The previous guideline is 3-6 months of living expenses. In the case of Indians in the USA, I highly recommend targeting the 6 month mark because of the uncertainties surrounding the visa.

- Add Essentials Only: Add together the rent, utilities, food, insurance premiums, the minimum debt payments, and phone bill. Do not have discretionary spending such as entertainment, dining out and subscriptions.

- Examples: In case you need to spend $3,000 monthly on necessities, the amount you should set your emergency fund is 18,000.

Step 2: Get Small, But Get Going.

The end number will not put you off.

- Micro-Goal 1: To have your first emergency fund of 1,000 dollars saved to you, as a starter fund to use in case of small emergencies.

- Micro-Goal #2: Then, target one month costs (in our case, 3,000).

- Keep doing that until you reach your 6-month objective.

Step 3: Select the Account.

Your emergency fund must be secure and easily available. It is not to be invested in the stock market.

Best Alternative:A High-Yield Savings Account (HYSA). These products, which are provided by online financial institutions such as Ally, Discover, or Marcus, have much higher interest rates than the traditional brick and mortar financial institution. Your money is not tied up (you can transfer its contents to your checking account within a couple of days) and earns interest without any risk to the principal.

Step 4: Automate Your Savings

The simplest method of saving is to automate it.

- Automatically transfer the money in your checking account to your HYSA at the very end of the month after receiving your paycheck. Even $200 or 100 dollars a month is remarkable every month. Take this delivery as a bill which is not negotiable.

Step 5: Feed your Pocket with Windfalls.

Speed up the process and invest any unscheduled money in your emergency fund:

- Your annual Diwali bonus.

- Your tax refund.

- Cash gifts from relatives.

- They saved money by not traveling to India in a given year.

Step 6: Replenish if Used

When you withdraw money out of your fund to actually spend on an emergency, the second financial task you must undertake is to stop other savings and restore it to its desired size.

FAQs

Q1: I am an F1 student who has a very low income. How can I possibly save?

Start incredibly small. Even $20-$50 per month is a win. The amount of the habit is not as important as the habit itself. Job on campus income or any stipend. A mini-fund of $500-1000 to buy a textbook, mend a broken phone on the spur of the moment, or a co-pay is a great start as a student.

Q2: Which one should I settle with my Indian education loan or save an emergency fund?

This is a classic dilemma. I suggest a mixed strategy. First establish a small emergency savings of one thousand to two thousand dollars. This shields you against new, high interest American debt. Then, in a frenzy, pay down your Indian loan. When that is done, re-establish your full 6-month US emergency fund.

Q3:Would I invest in the stock market or cryptocurrencies using my emergency fund when the market is down?

Absolutely not. This money is not meant to grow but to ensure security. It is such a temptation but combining these is risky to your financial safety. You must keep these pots of money quite separate.

Q4:Where am I going to keep my emergency fund in India or the USA?

Where you live and have expenses, this should always be your primary emergency fund in the country. When you are living in the USA, you must have your money in a HYSA in the USA.

My Personal Recommendation

Experiencing the anxiety of visa problems, the most valuable lesson that I can teach is to focus on your emergency fund first before pursuing nearly all other financial objectives (unless you receive any employer 401(k) match). Its value is in the peace of mind it gives. It turns a possible disaster into an easily bearable inconvenience. Create a High-Yield Savings Account now, establish an auto-transfer even to a small account and begin creating your financial airbag. It will be appreciated by your future self, who will be facing an RFE or family emergency.