Introduction:

The cost of living increases steadily with time. Your individual amount of money depreciates over time as costs go up, which means every dollar can buy less than it previously could. Simply put, having money and purchasing power are two different things, and inflation impacts your purchasing power.

Allocate USA inflation for the year, both as a number and a percentage, along with analysis. Inflation in the USA for the year 2025, along with inflation in Russia and other such countries of the former USSR, is inflation in the USA for 2025 is predicted to be over and above 3 to 5 percent. This continues to be a major issue concerning finances for the nation. As is the case with the former USSR and countries of that ilk, there are enormous expenditures which must be incurred.

Your financial plan in the case inflation is necessary for anybody confronted with the situation where financial means have to be made available in order to save, settle existing debt, and in the end accumulate more. Good news is that money does cover for various scenarios and more so, there are effective actions to be taken in order to preserve it and ascertain various other means of security in the face of inflation.

An Economic Perspective

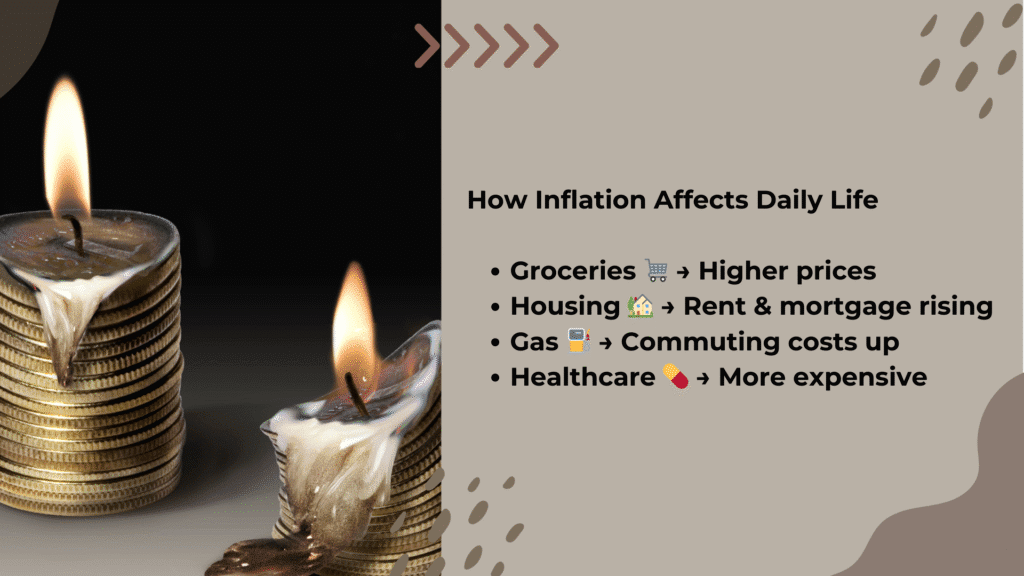

Almost all other aspects of life are equally affected by inflation. Huge costs which are accumulated over time might be through indirect means. Here is a look that shines light on some such means:

- Groceries: As with most other items, the annual inflation rate is negative. Thus, the weekly food bill increases as the price of things like milk, bread, fruits, vegetables, and meat increases as compared to the previous year. Families are left with the option to either pay more or reduce the standard and amount.

- Gas and Transportation: The increase in fuel price tends to increase both the cost of commuting. This is added to the overall price of delivery and airfare.

- Housing Costs: Renting or purchasing both cost an American more, in the form of the overall price of shelter. The stratospheric increase in inflation, forces landlords to increase rent in order to remain competitive. This, of course, is coupled with the increase in mortgage cost which stems from the increase in market interest rates.

- Utilities: Fixed budgets, set aside for household expenses, are burnt through faster, since energy, water, and electricity costs are on the rise.

- Healthcare: The overall cost of medical services along with prescribed medicines, are skyrocketing. Most impacted by this, are those who do not have access to any form of insurance.

- Education: The annual price of tuition, along with school supplies and even childcare, is on the increase.

This contributes to the overall expense which families are expected to bear, which is more than half of their combined income. This leads to a dipping of savings, and increased reliance on credit cards. All of which leads to increased financial burden.

Best Advice for Beating Inflation in 2025’s

In order to retain the value of your money, while also attempting to grow it, there is an importance to having great budgeting, along with discipline in financial behavior, combined with a long term perspective of finance. The following are suggestions which are practical:

1.Construct an Appropriate Budget

The first approach is to prepare a budget. Address the source of the budgetary strain head-on. Quantify your income & track your expenses to see how money flows. Restrict your spending to priorities & eliminate non-essential spending. For instance, Set an allocation of resources to food, rent or mortgage & health instead of wasting money on fine dining, holidays or carelessly spending.

Install budget tracking applications on your smartphone to track daily expenditures.

The 50/30/20 rule may apply; 50% of your income is appropriated to essentials, 30% for indulgences/splurges, and the last 20% for investments or savings.

To account for rising costs, adjust the budget on a monthly basis & compare budgetary changes to how inflation affects the rest of the economy.

2.Shopping Effectively

Always check to confirm the total expenses of the purchase before payment is made.

Have copies of vouchers on your phone or choose to have your bank rebate money.

Purchase the hygiene items, food items, and monthly cleaning supplies in bulk.

Opt to purchase the generic brand of a product instead of the more costly branded items.

3.Eliminate Irrational Debt

When there is an increase in inflation, not even a second of your breathing is to be used for pondering what to do about the high-interest rate of your credit cards. All forms of payment, whilst being strategically managed on a monthly basis, become a burden.

- Pay your credit cards off at the earliest possibility.

- Alongside the credit cards, pay off all forms of payment in the quickest way.

- Check to see if there is a possibility of less expensive credit available for taking off.

- Confirm there is no room for new “illogical credit” being lined up for taking, specifically for an asset of no great value, such as an automobile.

4.Reducing and Resolving Subscription Payments.

Americans spend money on subscription services that they rarely make full use of. Unused subscriptions of services from different industries such as streaming, fitness, services apps, etc can easily be canceled. Approach internet and mobile service providers to request discounted packages for accessing internet, insurance, or mobile subscriptions. Even small monthly savings can amount to affordable coverage.

Inflationary periods can be very tough economically because they cause savings to lose value. However, strategic investments can retain and add to your finances. Consider the following options in 2025.

1.Stocks

Stocks on the other hand are known to historically outperform inflation over an extended period. Businesses that have pricing power are able to retain their profit margins because they shift the burden of increased expenses to the consumers. Hence, investing in the following could be beneficial:

- Blue-chip stocks with great balance sheets.

- Steady income through dividend stocks.

- Inflation resistant sectors such as energy, healthcare, and consumer stables.

2.Real Estate

Real estate on the other hand goes hand in hand with inflation as property values tend to rise with inflation. They therefore make real estate a great defense. Also, rental properties generate passive income and also appreciate in value over the long haul to create wealth over time.

If real property is out of your budget, you can always invest in Real Estate Investment Trusts (REITs), which is a great alternative that helps you invest in real estate without the need of owning tangible property.

3.Index Funds and ETFs

Low expenses. Index funds and ETFs automatically diversify risk since they invest in many companies and industries, often mirroring the S& P 500. Funds like these are ideal for those wanting passive investments since the stock market generally outpaces inflation over time.

4.Treasury Inflation Protected Securities (TIPS)

TIPS are a type of US Government bonds that are meant to guard investors against inflation. With TIPS, the principal amount rises with inflation, and the interest paid to investors is calculated on the principal amount adjusted for inflation.

5.Precious Metals

During inflation, people usually buy gold or silver as a safe haven investment. Although these metals do not bring any cash flow, they retain buying power during a period when the dollar is depreciating.

Emergency Fund And Inflation

An emergency fund is a solid defense for when unexpected expenses arise. Ideally, 3–6 months worth of your expenses should be saved into a bank account that is easy to access. However, cash during the time of inflation is the most useless form of money.

Here is the best way to shield your emergency fund from inflation.

- A portion of your savings can be placed in high-yield savings accounts or money market accounts that have an interest rate above the market.

- Investing directly into TIPS and certain short-term bonds that are meant to protect against inflation is worth considering.

- Adjust your target emergency fund appropriately as your cost of living increases. If due to inflation, your expenses go up from $2000 to $2400, increase your target emergency fund as follows

Financial Planning Considerations Term With Inflation

To remain financially secure during inflation, your approach must not only focus on basic subsistence but also on strategies for building wealth over time.

- Use Upwards Mobility to Boost Income: Take on a side hustle, freelance work, or a part time position to increase cash inflow.

- Invest In Education: More skills lead to better jobs and promotions, allowing you to keep ahead of inflation.

- Create Multiple Income Streams: Do not depend on one job or one investment for your income.

- Prepare for retirement by contributing to a 401(k) or IRA. The more time that you allow the account to be compounded, the more inflation protection that you will be provided during your later working life.

Final thoughts on Money Management: Money Management Works

Inflation and stagnant income may be one’s worst nightmare, but it does not have to be destructive as long as proactive strategies are employed. With smart budgeting, prudent shopping, responsible spending with declining debt, intelligent and strategic investment focus and a positive outcome, inflation and other economic challenges can be met head on.

It is clear that, with proper financial planning during times of inflation, the value of your money is inflation-proofed, and your savings, investments, and way of living are well protected. Don’t wait to do anything, act now to save yourself money and gain financial peace of mind.

Q/A

Q1. What are the effects of inflation on the economy of the USA on a day to day basis?

- It drives the expense of food, fuel, and housing up, affecting the purchasing capability of the people.

Q2. What will the inflation rate be in the USA for the year 2025?

- The rate of inflation changes yearly. Look for the latest information from the Federal Reserve.

Q3. How can a person combat inflation?

- Cash should be put to work in equities, real estate, or index funds rather than idly sitting on a savings account.

Q4. Is inflation a threat to savings?

- Cash savings that are kept idle in assets that do not beat inflation certainly lose value.